The Ugly Numbers Are Finally In On The 2017 Republican Tax Scam

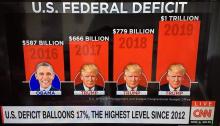

Using official Trump administration data, the report linked below shows how horribly unfair the Trump / Republican 2017 tax scam was.

The first data showing how all Americans are faring under Trump reveal the poor and working classes sinking slightly, the middle class treading water, the upper-middle class growing and the richest, well, luxuriating in rising rivers of greenbacks.