Tax Policy

Republican Tax Scam Hits Millions Who Can't Deduct State and Local Taxes

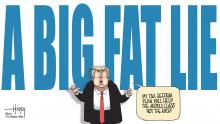

The Republican tax scam has been discussed repeatedly at SmartDissent.com and on our Twitter and Facebook accounts. This post touches on the impacts of the GOP eliminating deductions for state and local taxes, which will cause the tax bills for millions of Americans to INCREASE.

The law limited the amount of state and local taxes -- or SALT -- that taxpayers can write off, a change most acutely felt in high-tax states including New York, New Jersey, Maryland and California, where tax bills can easily exceed the threshold.

Trump/GOP $1,500,000,000,000 Tax Scam Had No Major Impact on Hiring But Made GOP Congress Rich

Near the end of 2017, Republicans scammed the county with a tax heist for the richest individuals and corporations. Not only did they drastically cut their taxes, they increased those in the middle class. And as has always been the case because 'trickle-down economics' is a debunked made-up concept, they pocketed the hundreds of billions of dollars.

The GOP Tax Scam: Corporations Get Richer, Wages Flat, Jobs Lost

The Republican tax scam in late 2017 was known by all intelligent people to be a massive giveaway to the wealthiest Americans and largest corporations. Most everyone else besides them would eventually see their tax burden INCREASE. If you're reading this web site, you know this already so instead let's share some new analysis from mid-November on the impacts after one year.

Nearly a year after the tax cut, economic growth has accelerated. Wage growth has not. Companies are buying back stock and business investment is a mixed bag.

NOT A DRILL: Republican Congress Admits They Are Coming For Your Social Security and Healthcare. VOTE THEM OUT.

The GOP agenda, in 3 simple steps:

Step 1: Cut taxes on corporations and the rich, increasing deficits

Step 2: Induce panic about high deficits, cut health care spending for the poor and elderly in response

Step 3: Repeat

Tax cuts reduced corporate tax revenue by almost a third even though corporate profits are through the ceiling. If Republicans win, they will push a “grand bargain” - no corporation pays a penny more but Medicaid, Medicare, and Social Security will be on the chopping block.

WE CAN NOT ALLOW THIS.

Under the Fog of Kavanaugh, House Republicans Pass $3.8 Trillion More Tax Cuts for Wealthy

Every day with Trump and the Republican Congress is a devious game of misdirection. There's an unimaginable amount of scandals filling the headlines, crowding and clouding the news cycle, making it nearly impossible to pay attention to the destructive Republican policies being enacted out of sight. Things that would normally dominate the news and our national discussions for days, weeks, or months never even get mentioned -- no one even hears about it. This. Is. Terrifying.

Republicans Will Cut Medicare and Social Security Admits Larry Kudlow, the TV Show Host Now Advising Trump

Trump administration officials and many Republicans are so lost in their bubble they sometimes say out loud exactly the evil they plan to do. It's as if their stupidity overtakes their evil for a moment and they give up their entire game plan to us. Is anyone paying attention?

A top economic adviser to Trump said on Monday [9/17/18] he expects.... there would likely be an effort in 2019 to cut spending on entitlement programs. Kudlow did not specify where future cuts would be made.

GOP Wants a Second Tax Heist For Extremely Weathy; Adds $3,800,000,000 to Deficit

Republicans screamed at the top of their lungs for eight years under President Obama about budget deficits and our national debt. They blamed him for bank bailouts initiated before his term. They shot down vital stimulus plans to bring our economy out of a total collapse and, you know, make America great again.

As we wrote about in June 2018, the Republican tax heist is causing massive budget deficits.

Trump Eliminates Pay Raises for Federal Employees Despite Cutting Taxes for Wealthy & Claiming Economy is Great

Trump said he's eliminating a pay raise for civilian federal employees slated for 2019 in order to "put our Nation on a fiscally sustainable course." He and Republicans fell all over themselves to give trillions of dollars of tax cuts to the wealthy and to big businesses, and they want to give them even more. But when it comes to working people, retirees, and the disabled, suddenly deficits matter again.

Tariffs Are Taxes: Trade War Making Thousands of Products More Expensive

Trade barriers such as tariffs have been demonstrated to cause more economic harm than benefit. They raise prices and reduce availability of goods and services resulting in lower income, reduced employment, and lower economic output.

Rather than erect barriers to trade that will have negative economic consequences, policymakers should promote free trade and the economic benefits it brings.