Share

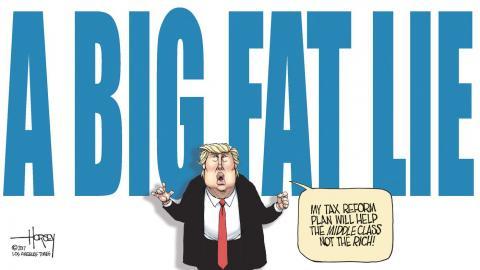

Not April Fools: The Rich Really Do Pay Lower Taxes Than You

As the old refrain goes, “Nothing can be said to be certain except death and taxes.” However, for the corporations and the wealthy, there is no certainty about paying taxes at all. In fact, in the United States, evading taxes has become as simple as creating a shell company in Bermuda.

For the first time on record, the 400 wealthiest Americans last year paid a lower total tax rate — spanning federal, state and local taxes — than any other income group.... That’s a sharp change from the 1950s and 1960s, when the wealthy paid vastly higher tax rates than the middle class or poor. Since then, taxes that hit the wealthiest the hardest — like the estate tax and corporate tax — have plummeted, while tax avoidance has become more common.

Trump’s 2017 tax cut, which was largely a handout to the rich....helped push the tax rate on the 400 wealthiest households below the rates for almost everyone else. The overall tax rate on the richest 400 households last year was only 23 percent, meaning that their combined tax payments equaled less than one quarter of their total income. This overall rate was 70 percent in 1950 and 47 percent in 1980.

Trump’s tax cuts have never been popular because so many benefits only help the rich. The rich got richer.... and the Republican-led Congress didn’t reduce spending to match the lower revenue from the tax cuts. Instead, it approved large budgets that added trillions more to the debt.

For middle-class and poor families, the picture is different. Federal income taxes have also declined modestly for these families, but they haven’t benefited much if at all from the decline in the corporate tax or estate tax. And they now pay more in payroll taxes (which finance Medicare and Social Security) than in the past. Over all, their taxes have remained fairly flat.

The combined result is that over the last 75 years the United States tax system has become radically less progressive.

Tax injustice has led to vast inequality in wealth and power.

The American economy just doesn’t function very well when tax rates on the rich are low and inequality is sky high. It was true in the lead-up to the Great Depression, and it’s been true recently. Which means that raising high-end taxes isn’t about punishing the rich (who, by the way, will still be rich). It’s about creating an economy that works better for the vast majority of Americans.

I already know what some critics will say about these arguments — that the rich will always figure out a way to avoid taxes. That’s simply not the case. True, they will always manage to avoid some taxes. But history shows that serious attempts to collect more taxes usually succeed.

Ask yourself this: If efforts to tax the super-rich were really doomed to fail, why would so many of the super-rich be fighting so hard to defeat those efforts?

Source: https://www.nytimes.com/interactive/2019/10/06/opinion/income-tax-rate-wealthy.html